working in nyc living in nj taxes

An accountant can help keep you in compliance with tax laws by calculating payroll taxes for the employees of yours or even keeping up with sales tax changes. I am being pursued by the New Jersey Division of Taxation to pay taxes from 2015 to.

Memo Before The Lockdown Did You Commute To Another State To Work But Now Are Working From Home You Should Read This Memo Chris Whalen Cpa

So if you live in New Jersey and work.

. You have two mechanisms to pay your New Jersey personal income taxes. Speaking of taxes youre also paying less in sales tax overall. Youre also responsible for city income tax if you live in NYC and work in NJ.

Youll need to file as a non-resident to pay NJ taxes on wages earned in the state AND file as a resident to pay NY taxes. Lets take a step back. Through withholding on your wages or by making quarterly estimated tax.

Remember that you file taxes and claim all income in the state where you reside. 5525 on taxable income between 40001 and 75000. Ive been a resident homeowner in New Jersey for nine years.

Self-employed individuals who make over 50000 per year must pay 34 of the net profit earned on their self. The rate varies from 3078 percent to a top. Impromptu97 On the NY return all worldwide income is included and taxed then they allow a credit for taxes paid to NJ another state on the same income.

Answer 1 of 4. If you shop in an area that is designated as an. Eventually moving to CT.

New York State income tax rates range from 4 to 882 as of 2019. New Jersey Tax Brackets 2019 - 2020. Teacher health insurance works pretty much anywhere.

NYC Taxes - live in NYC but travel overnight outside of NYC for work New York City 17 replies Living in NYC. However youll receive a tax credit on your NY taxes for. Do the NJ return.

New York has a sales tax of 8875 while New Jersey has a sales tax of 6625. You will have topay taxes to NY and NJ though but its usually not much to NJ because they have some reciprocal agreements and. NYC Personal Income Tax.

Living in New Jersey working in NYC - Tax Question - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. You are not double-taxed. Ahhhhh sigh of relief.

Tax withholding is required. But if you are self-employed you may be subject to this tax. Although living in New Jersey eliminates the need to pay New York city tax the New York state tax can still be costly.

The state tax in New York begins at 4 and can reach 882 while in. I work in New York City.

Solved I Live In Nj But Work In Ny How Do I Enter State Tax

Out Of Town Workers Still On Hook For Taxes The Riverdale Press Www Riverdalepress Com

:max_bytes(150000):strip_icc()/GettyImages-538594694-791e2c621e27472fbdf9a3f1b7cfcb67.jpg)

Benefits Of Living In Nj While Working In Nyc

I Work In N Y But Live In N J Why Do I Have To Pay N J Tax Nj Com

Best Places To Live In New Jersey North South And Central

The Pandemic Flight Of Wealthy New Yorkers Was A Once In A Century Shock The New York Times

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

Remote Workers May Owe New York Income Tax Even If They Haven T Set Foot In The State Marks Paneth

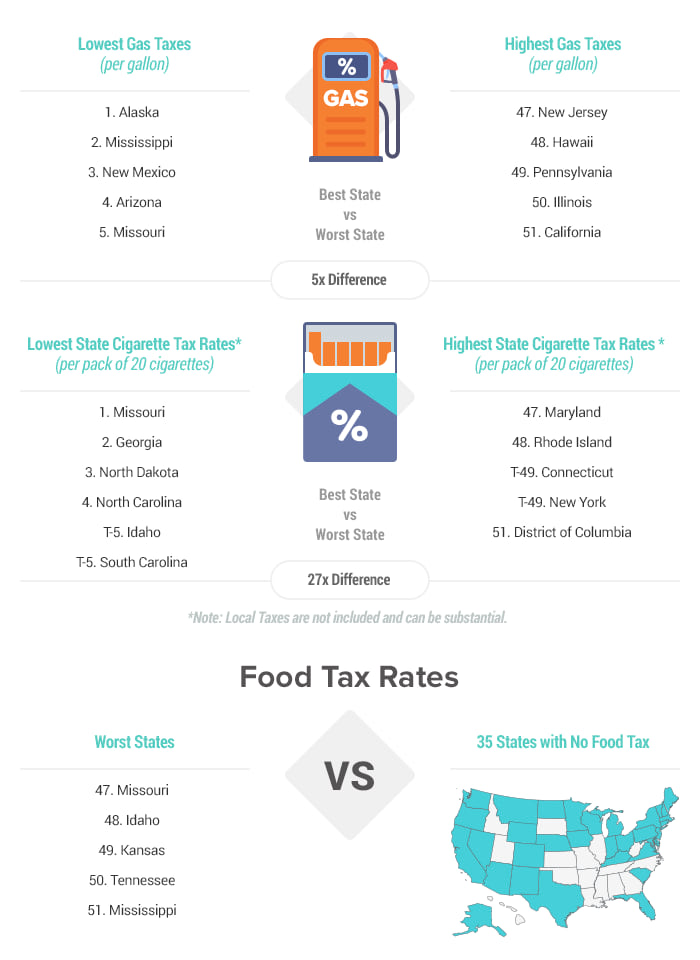

States With The Highest Lowest Tax Rates

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Sales Taxes In The United States Wikipedia

Filing Taxes In Two States Working In Ny Living In Nj Priortax

Nyc Congestion Pricing Options Studied By Mta Would Charge Nj Drivers

New York State Income Tax Compared To New Jersey Income Tax

Solved Remove These Wages I Work In New York Ny And Live In New Jersey Nj

Which State Is Better To Live For A New Yorker Financially Connecticut Or New Jersey Asking As A School Age Twin Parents Quora

The New Jersey Double Tax Do Nj Residents Get Taxed Twice

Best Places To Live In New Jersey North South And Central

If I Work In Ny But Live In Nj Do I Pay Taxes In Both States