nh meals tax payment

There is also a 85 tax on car rentals. Accordingly New Hampshire is listed as NA with footnote 11.

Historical New Hampshire Tax Policy Information Ballotpedia

For additional assistance please call the Department of Revenue Administration at 603 230-5920.

. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor vehicle rentals.

I own and host a house in Bretton Woods New Hampshire. After that your nh meals and rooms tax form is ready. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

603 230-5945 Contact the Webmaster. Pay taxes and more. See reviews photos directions phone numbers and more for Meal Tax locations in Bedford NH.

A Hill Town of New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. NH imposes a 9 percent tax on meals and rooms with a 3 percent vendor discount. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

If you need any assistance please contact us at 1-800-870-0285. The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. Fillable PDF Document Number. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

It lists information on general sales taxes. An immediate concern is the opportunity this creates for fraudulent efforts to gain business information or even seek payment of fraudulent tax bills. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

If you have questions call 603 230-5920. TIR 2021-004 2021 Legislative Session in. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH.

Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. The meals tax rate is 625.

They should also notify the New Hampshire Department of Justice DOJ by calling its Consumer Information Line at 888-468-4454 or 603-271-3643. AirBnB does not allow me to collect state mandated Meals and Rooms Tax or any other kind of tax. If you have any questions about tax-exempt sales please call the Departments Division of Taxpayer Services for clarification at 603 230-5030.

603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. Nh meals tax payment Monday February 28 2022 Edit.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Hill Town of New Hampshire. Elderly Services Town Of Plaistow Nh Registering with the dor. DOJs first course of action will be to make.

HELOC Payoff Calculator Use this calculator to help determine the number of months necessary to repay a home equity line of credit in order to meet your financial goals. Some schools and students. Enter your total tax excluded receipts on line 1 excluded means that the tax is separately stated on the customer receipt or check.

See reviews photos directions phone numbers and more for Meal Tax locations in Nashua NH. Home page to the New Hampshire Department of Revenue Administrations website. See reviews photos directions phone numbers and more for Meal Tax locations in Amherst NH.

Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served. We pay 9 percent which goes into state coffers well most of it. Motor vehicle fees other than the Motor.

LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax. The Meals and Rentals MR Tax was enacted in 1967. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Ad Do You Have IRS Debt Need An IRS Payment Plan. Its only on prepared meals room and vehicle rentals. Under New Hampshire State law I am now obligated to collect the 9 Meals Rooms MR tax for the NH Revenue Administration.

Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates.

Tax Year 2021 April Filing Deadline for Interest Dividends and Business Tax Returns. The MR Tax is paid by the consumer and is collected and remitted to the State on the 15th of each month by operators of hotels restaurants or. New hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives For an up-to-date list of. Meals paid for with food stampscoupons. Please mail TAX PAYMENTS ONLY to the following address.

A 9 tax is also assessed on motor vehicle rentals.

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Favorite Maine Recipes Poster Excuse The Comic Sans Font I Ve Got Maine On The Mind Maine Food Recipes

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax Money Choices

Pin By Bellshomestead On Planning Our Homestead Food Protection Prepared Foods Things To Sell

Nh Dept Of Revenue Administration Launches New Online User Portal For Paying Taxes And More Manchester Ink Link

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Free Tenant S Affidavit Of Payment Template Google Docs Word Template Net Being A Landlord Operations Management Word Doc

Muddy Moose Restaurant Pub North Conway North Conway Nh Pub

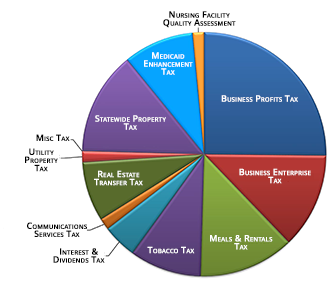

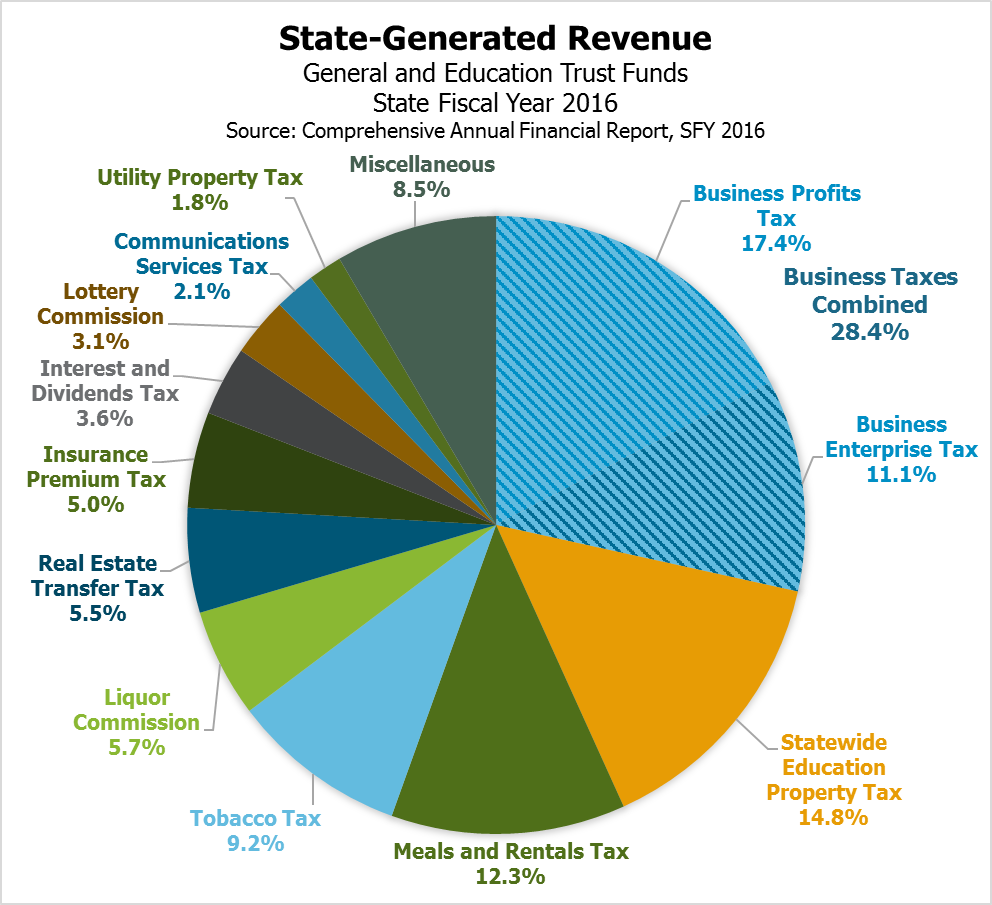

Transparency Nh Department Of Revenue Administration

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

New Hampshire Meals And Rooms Tax Rate Cut Begins

Revenue In Review An Overview Of New Hampshire S Tax System And Major Revenue Sources New Hampshire Fiscal Policy Institute

Pin By Park Inn By Radisson Gurgaon B On Park Inn Radisson Bilaspur Meals Happy Family Food

New Hampshire Revenue Dept Launches Final Phase Of Tax System